Are you ready to turn your business dreams into a reality? A startup business loan can be your golden ticket to success, helping you fuel your entrepreneurial journey.

But what exactly can you use this loan for? In this article, we’ll explore the multitude of possibilities that a startup business loan offers. From purchasing equipment and funding marketing campaigns to hiring employees and expanding your business, the options are limitless.

The specific use of the loan will depend on your unique needs and goals as a startup, as well as the terms and conditions of the loan agreement.

So, let’s dive in and discover how a startup business loan can bring your entrepreneurial vision to life.

What is a Startup Business Loan?

A startup business loan is a type of financing that’s specifically designed for new businesses. It provides the necessary funds to cover various expenses and investments, such as purchasing equipment, hiring employees, marketing campaigns, and operational costs.

Startup business loans offer entrepreneurs the financial support they need to get their business off the ground and pursue growth opportunities.

What Can You Use It For?

You can use a startup business loan for a variety of purposes, including purchasing equipment, funding marketing campaigns, hiring employees, covering operational expenses, and expanding your business.

A startup business loan provides financing options to help cover various business expenses and fund your business’s growth. Whether you need to invest in new equipment to improve your operations, launch a marketing campaign to reach more customers, or hire additional staff to support your growing business, a startup business loan can provide the necessary funds.

It allows you to have the financial flexibility to meet your business’s needs and take advantage of opportunities for expansion. With a startup business loan, you can secure the necessary funding to support your business’s growth and success.

Types of Financing for Startups

When it comes to financing options for your startup, there are several types to consider.

Traditional loans provide a lump sum for various expenses, while equipment financing allows you to purchase necessary equipment with the loan.

Lines of credit function like credit cards, giving you access to funds as needed, and business credit cards offer a convenient way to make purchases and build credit.

Traditional Loans

One common type of financing for startups is through traditional loans, which provide a lump sum or a line of credit for various expenses. Traditional loans, also known as business startup loans, are a popular option for entrepreneurs looking to secure funding for their new ventures.

These loans are offered by banks, credit unions, and online lenders, and they typically require a solid business plan, expense sheet, and financial projections. Traditional loans can be used for a variety of purposes, such as purchasing equipment, funding marketing campaigns, hiring employees, and covering operational expenses.

While banks may have stricter requirements for startups, online lenders and smaller banks can be more flexible in providing financing through their loan programs.

Equipment Financing

Startup business loans can be utilized for acquiring machinery, tools, vehicles, technology, software, specialized equipment, office furniture, and computer systems.

Equipment financing is an important aspect of startup financing as it allows businesses to obtain the necessary assets to operate and grow.

When seeking equipment financing, it’s important to consider the loan amounts available and the specific needs of your business. Different loan options may have different requirements and terms, so it’s important to compare and choose the best option for your startup.

Lines of Credit

You can utilize a line of credit as a type of financing for your startup business. Lines of credit function similarly to credit cards, providing you with the flexibility to access cash for various business purposes while paying interest only on the amount you use.

Here are three key benefits of using a line of credit for your startup:

- Flexibility: A line of credit allows you to access funds when you need them, giving you the flexibility to manage your cash flow and address immediate business needs.

- Cost-effective: You only pay interest on the amount you use, making it a cost-effective financing option compared to traditional loans where you pay interest on the entire loan amount.

- Ongoing access: Unlike a one-time loan, a line of credit provides ongoing access to funds, allowing you to borrow and repay as needed, making it a convenient option for managing your business’s financial needs.

Using a line of credit can be a valuable tool in meeting your startup’s financial requirements and supporting its growth.

Business Credit Cards

Continuing the discussion on types of financing for startups, consider utilizing business credit cards as a convenient and flexible option to manage day-to-day expenses and build credit for your business.

Business credit cards function like credit cards, providing quick access to funds and offering flexibility for startup businesses. They can be used for various startup expenses, including purchasing supplies, managing day-to-day operations, and covering marketing and advertising costs.

By using a business credit card responsibly and making timely payments, you can avoid interest, fees, and potential negative impact on your startup’s credit score. Additionally, business credit cards can be used to finance purchases such as office equipment, technology upgrades, and specialized industry-specific tools.

This type of financing can provide you with the capital you need to support and grow your startup business.

Invoice Factoring/Financing

Invoice factoring is a financing option that allows startups to sell their accounts receivable at a discount in exchange for immediate cash. This can be a helpful solution for startups that are facing cash flow challenges due to outstanding invoices. By leveraging invoice factoring, startups can access the funds they need without taking on additional debt.

Here are three key benefits of invoice factoring for startups:

- Improved Cash Flow: Invoice factoring provides immediate cash, which can help startups meet their financial obligations and maintain a healthy cash flow. This allows them to continue operating smoothly and pursue growth opportunities.

- Debt-Free Financing: Unlike traditional loans, invoice factoring doesn’t require startups to take on additional debt. Instead, they’re selling their accounts receivable, which can help them avoid the burden of repayments and interest.

- Accurate Cash Flow Projections: With invoice factoring, startups can have a more accurate understanding of their cash flow since they receive immediate payment for their invoices. This allows them to make more informed financial decisions and plan for the future.

Invoice factoring can be a valuable financing option for startups that are looking to improve their cash flow and access working capital without taking on additional debt.

Online Lenders

When considering options for financing your startup, one viable choice is to explore the opportunities offered by online lenders. Online lenders provide business loans that can be used to fund various aspects of your startup, from purchasing equipment to covering operational expenses.

Applying for a loan with an online lender is typically a straightforward process. You can start by researching different online lenders and comparing their terms and interest rates. Once you have chosen a lender, you can begin the loan application process, which usually involves providing information about your business, financial statements, and credit history.

Online lenders offer a convenient and accessible way to secure startup funding, making it easier for entrepreneurs to get the financial resources they need to launch and grow their businesses.

Credit Unions and Other Financial Institutions

If you’re considering financing options for your startup, credit unions and other financial institutions can provide valuable resources to help fund your business. Here are three reasons why you should consider credit unions and other financial institutions for your startup financing:

- Personal loans: Credit unions often offer personal loans that can be used for business purposes. These loans can be a good option for startups, especially if you have a strong personal credit score.

- Lower interest rates: Credit unions typically offer lower interest rates compared to traditional banks. This can help you save money on interest payments and make your loan more affordable in the long run.

- Support for small businesses: Credit unions and other financial institutions are often more willing to work with startups and newer businesses. They understand the challenges faced by entrepreneurs and can provide the guidance and support you need to succeed.

Preparing to Apply for a Loan

Before applying for a startup business loan, there are a few key points to consider.

First, you’ll need to develop a solid business plan and mission statement to showcase the potential of your venture.

Next, it’s crucial to research different loan options and terms to find the best fit for your business needs.

Additionally, determining your credit score and history, as well as estimating your annual revenues and monthly payments, will help you understand your financial standing and repayment capabilities.

Developing Your Business Plan and Mission Statement

To properly prepare for applying for a startup business loan, it’s crucial that you develop a comprehensive business plan and mission statement that clearly outline your company’s mission, financial projections, and market analysis. This won’t only demonstrate your understanding of your business and its potential for success, but also provide potential lenders with the information they need to make an informed decision about your loan application.

Here are three key reasons why developing a business plan and mission statement is essential when seeking funding options for your startup:

- Demonstrates your vision and strategy: A well-crafted business plan showcases your goals, target market, and how you plan to use the loan funds. This helps lenders understand your business’s potential for growth and sustainability.

- Sets you apart from competitors: A strong mission statement differentiates your startup from others by highlighting your unique value proposition and conveying a sense of purpose and commitment. This can make your business more attractive to lenders.

- Provides a roadmap for success: A comprehensive business plan acts as a roadmap, outlining the steps you’ll take to achieve your goals. This demonstrates to lenders that you have a well-thought-out strategy for success.

Researching Different Loan Options and Terms

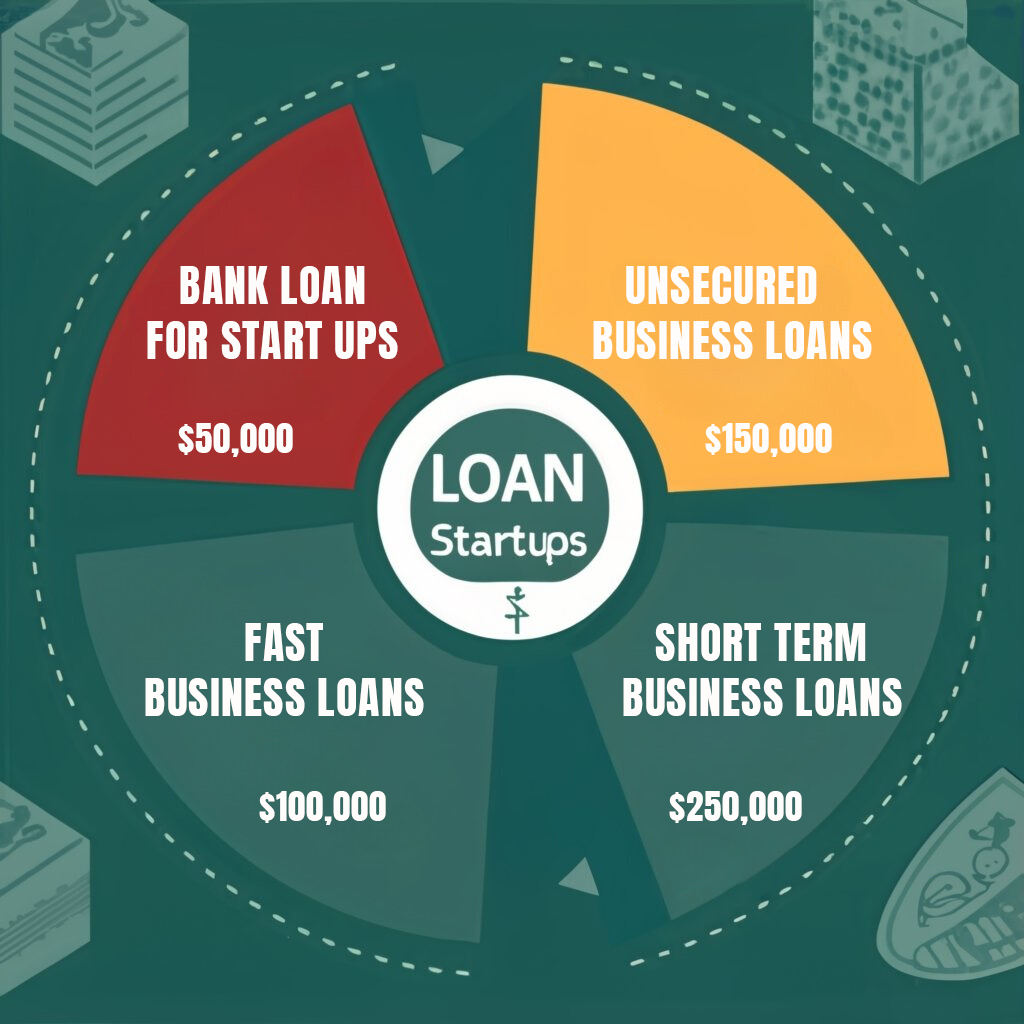

When researching different loan options and terms for your startup business, it is important to compare lenders and their eligibility criteria to find the best fit for your loan needs. Consider factors such as interest rates, repayment terms, and eligibility requirements. To help you make an informed decision, here is a table comparing different loan options for startups:

| Loan Option | Maximum Loan Amount | Minimum Credit Score | Estimated APR | Pros | Cons |

|---|---|---|---|---|---|

| Bank loans for startups | $50,000 | 680 | 13.00-15.00% | Competitive interest rates, no annual fee or prepayment penalties, available to borrowers with less than two years in business | Longer funding process, credit lines only available up to $50,000, need a Wells Fargo checking account to access online bill pay |

| Unsecured business loans | $150,000 | 600 | 36.00-99.00% | Fast funding, startup-friendly, low minimum credit score requirement, no prepayment penalties or fees | Higher interest rates compared to traditional banks, may require personal guarantee, weekly repayments required over a short term |

| Fast business loans | $100,000 | 625 | N/A | Quick approval and funding, suitable for startups | |

| Short-term loans | $250,000 | 625 | N/A | Short-term funding options |

Determing Your Credit Score & History

Check your credit score and history to determine your eligibility for a startup business loan. Your credit score plays a crucial role in the loan application process as lenders use it to assess your creditworthiness and determine the terms of the loan.

Here are three key steps to help you understand your credit situation before applying for a business loan:

- Obtain your credit report: Request a copy of your personal credit report from the major credit bureaus to review your credit history. Look for any errors or discrepancies that may negatively impact your credit score.

- Evaluate your credit score: Your credit score, which typically ranges from 300 to 850, reflects your creditworthiness. A higher credit score increases your chances of loan approval and favorable loan terms.

- Improve your credit history: If your credit score is lower than desired, take steps to improve it by making timely payments, reducing credit card balances, and addressing any negative marks on your credit report.

Estimating Annual Revenues & Monthly Payments

You can start preparing to apply for a loan by estimating the amount of annual revenues and monthly payments your startup business can afford. Estimating annual revenues is crucial as it helps you determine the realistic amount you can borrow and repay. By accurately estimating your monthly payments, you can create a comprehensive financial plan that aligns with your business’s needs and ensures effective utilization of the loan. To help you with this process, here is a table outlining the steps to estimate your annual revenues and monthly payments:

| Estimating Annual Revenues | Estimating Monthly Payments |

|---|---|

| Analyze market potential | Calculate fixed expenses |

| Identify target customers | Estimate variable expenses |

| Determine pricing strategy | Calculate loan repayment |

| Forecast sales | Determine affordability |

Frequently Asked Questions

Can I Use a Business Loan for Whatever I Want?

Yes, you can use a business loan for a variety of purposes. Common uses include purchasing equipment, funding marketing campaigns, hiring employees, covering expenses, expanding the business, refinancing debt, and investing in technology or infrastructure.

What Can a Business Term Loan Be Used For?

A business term loan can be used for a variety of purposes, such as marketing and advertising, equipment purchases, hiring and training costs, rent and utilities, licensing and legal fees, inventory, and real estate-related expenses.

Is It a Good Idea to Take Out a Loan to Start a Business?

Taking out a loan to start a business can be a good idea. It provides access to essential capital for startup costs, operations, equipment, and more. Just weigh the benefits against any restrictions on usage.

What Do Small Businesses Use Loans For?

You can use a startup business loan for various purposes, such as purchasing equipment, funding marketing campaigns, hiring employees, covering operational expenses, expanding the business, refinancing debt, and investing in technology or infrastructure.

Conclusion

In conclusion, a startup business loan can be used for a variety of purposes. These include purchasing equipment, funding marketing campaigns, hiring employees, and expanding your business. The specific use of the loan will depend on your unique needs and goals as a startup, as well as the terms and conditions of the loan agreement.

Understanding the potential uses of a startup business loan is crucial for making informed financial decisions and bringing your entrepreneurial vision to life.