In today’s fast paced financial world, personal credit cards are more than just plastic, they're powerful tools that can open doors, build your credit history, and reward you for everyday spending. But for many, they’re also a mystery wrapped in a layer of interest rates, fine print, and fancy jargon.

This blog aims to pull back the curtain.

Whether you’re applying for your very first card, navigating credit as a young adult, or trying to better understand the financial tools in your wallet, this guide will give you a crystal clear breakdown of what personal credit cards are, how they work, and how to use them wisely.

By the end, you’ll not only grasp the mechanics, you’ll know how to make your card work for you, not against you.

What Is a Personal Credit Card?

A personal credit card, also called a consumer credit card, is a financial product issued by a bank or credit union that lets you borrow money to make purchases, with the understanding that you’ll pay it back later. Every transaction you make on the card adds to a running balance that you’re responsible for repaying, either in full each month or over time (with interest).

Here’s the key distinction:

Unlike a debit card, which pulls money straight from your bank account, a credit card lets you spend using borrowed funds, up to a limit determined by your creditworthiness.

Credit cards are an essential part of the modern financial ecosystem. They not only make it easy to shop online or in-store but also help establish a credit history, which plays a major role in determining your ability to get loans, mortgages, or even rent an apartment.

They can also be surprisingly strategic. With the right approach, a credit card can help you rack up travel rewards, cashback bonuses, or consumer protections that cash and debit simply don’t offer.

How Personal Credit Cards Work

Understanding how personal credit cards operate is the key to using them effectively, without falling into the debt trap.

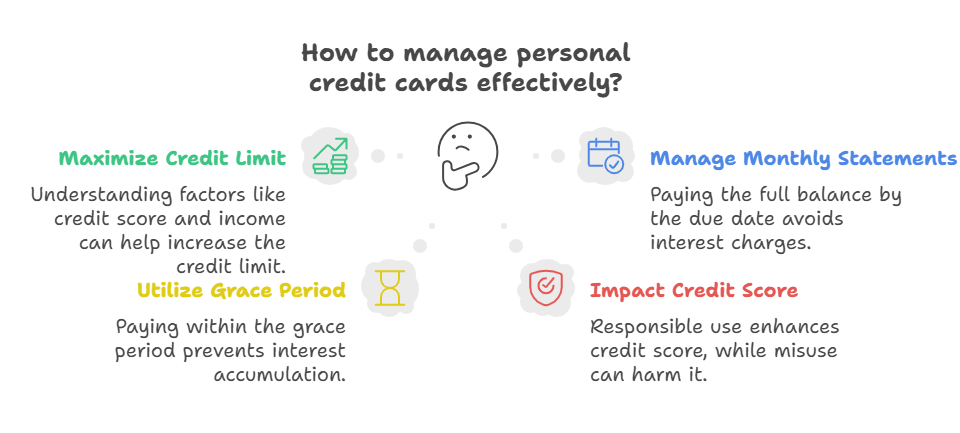

Credit Limit and How It’s Determined

Your credit limit is the maximum amount you can spend on your card. It’s determined by your credit score, income, debt-to-income ratio, and overall financial history. Think of it as your financial trust score, the better your profile, the higher the limit.

Monthly Statements and Repayment Cycle

Each month, your card issuer sends a statement showing all your transactions, the total amount you owe (called the “statement balance”), and the minimum payment due. You’ll also see a due date, typically 21–25 days after the billing cycle closes.

Pay your full balance by that date and you’ll avoid interest. Pay just the minimum? You’ll carry a balance, and interest starts ticking.

Interest and Grace Periods

A grace period is the window between the statement date and your payment due date. If you pay your full balance during this time, you won’t be charged interest on purchases. But if you carry a balance, interest (APR) applies, and it’s not cheap. Most cards charge 15% to 25% annually.

Impact on Credit Score and Credit Reporting

Your credit card activity gets reported to the major credit bureaus, Equifax, Experian, and TransUnion. Responsible use (on time payments, low credit utilization) can boost your score. But late payments, maxing out your card, or defaulting? That can sink it fast.

Credit cards are one of the most influential tools in shaping your credit history.

Types of Personal Credit Cards

There’s no one size fits all when it comes to personal credit cards. Here's a look at the main types:

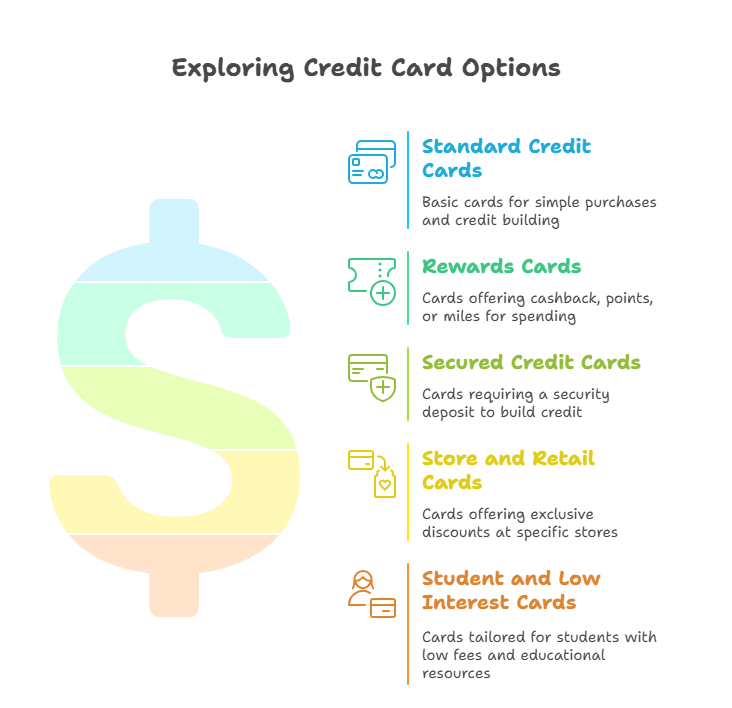

Standard Credit Cards

These are the no frills, no fuss cards. No rewards, no fancy perks, just a reliable tool for making purchases and building credit. Great for beginners or those who want simplicity.

Rewards Cards (Cashback, Travel, Points)

These cards offer bonuses for every dollar you spend. Some give cashback (think 1%-5%), others earn points or miles you can redeem for flights, hotel stays, gift cards, or statement credits. They're ideal for those who pay in full each month and want their spending to work for them.

Secured Credit Cards

Perfect for those with no credit or poor credit. A security deposit (usually $200 - $500) acts as collateral and determines your credit limit. Over time, with responsible use, you can graduate to an unsecured card.

Store and Retail Cards

Issued by retailers (like Amazon, Target, or Best Buy), these cards often offer exclusive discounts or promotional financing. But beware: they typically carry higher interest rates and can only be used at specific stores.

Student and Low Interest Cards

Tailored for students or new borrowers, these cards offer low or no annual fees, modest credit limits, and educational resources. Some even come with rewards and perks like credit score tracking.

Key Features to Know

Before you swipe, tap, or click “Add to Cart,” it’s crucial to understand what’s under the hood of your credit card. Here are the core features that can make or break your experience:

Credit Limit

Your credit limit is the ceiling on how much you can spend with your card. It’s based on your income, credit history, and overall financial behavior. Using too much of your limit (known as credit utilization) can hurt your credit score, keeping it under 30% is a smart rule of thumb.

APR: Fixed vs. Variable

The Annual Percentage Rate (APR) is the cost of borrowing if you don’t pay off your balance in full.

- Fixed APR: Doesn’t change often but can still shift with notice.

- Variable APR: Tied to market rates (like the Prime Rate), meaning your interest can rise or fall over time.

Either way, if you carry a balance, you’ll be paying more than you bargained for.

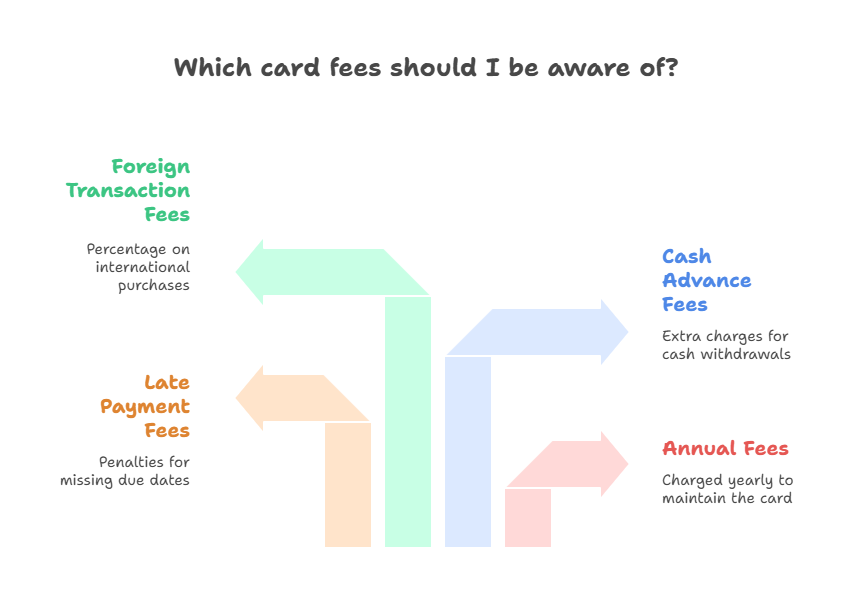

Fees to Watch Out For

Not all cards are free to hold. Common fees include:

- Annual fees – charged once a year just to keep the card

- Late payment fees – penalties for missing your due date

- Cash advance fees – extra charges for withdrawing cash from your card

- Foreign transaction fees – usually 1–3% on international purchases

Always check the fine print.

Perks and Protections

Many cards go beyond rewards. Look for extras like:

- Travel insurance

- Purchase protection

- Price protection

- Extended warranties

These benefits can save you hundreds, if you know they’re there.

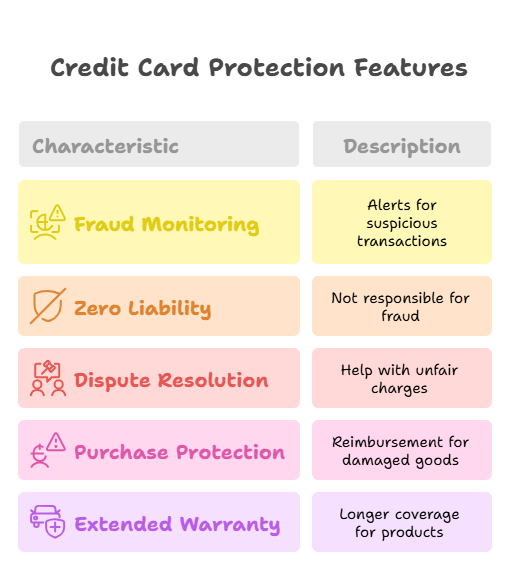

Security Features

Modern cards come armed with safety tech:

- Zero liability policies protect you from unauthorized charges

- Fraud alerts and two-factor authentication keep your account locked tight

- EMV chips and virtual card numbers offer even more protection during transactions

Behind the Scenes: How Credit Card Programs Operate

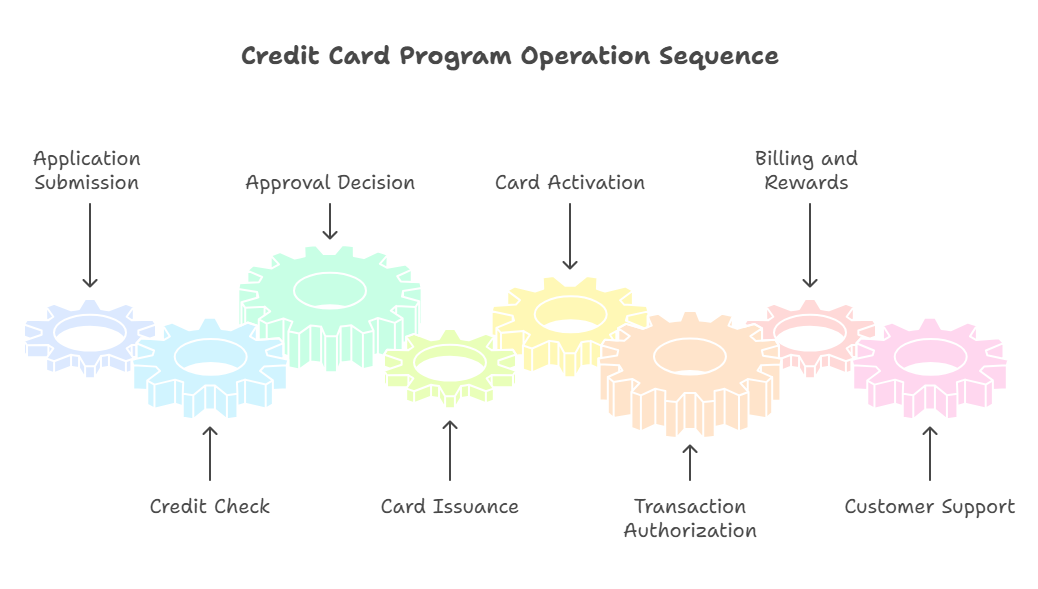

So what actually powers your shiny piece of plastic (or metal)? Credit card programs run on a complex but fascinating system behind the curtain:

Application and Approval Process

You apply, the issuer checks your credit score, income, and financial background, then decides: approve or decline. They’ll also determine your credit limit, APR, and card terms.

Pro tip: A hard credit check during this step can temporarily lower your credit score.

Issuance and Activation

Once approved, your card is produced, either mailed as a physical card or sent digitally for mobile wallets. You’ll need to activate it before use, usually by phone or app.

Role of Payment Networks

Cards are powered by global payment networks like Visa, Mastercard, American Express, and Discover. These networks:

- Authorize transactions

- Set merchant rules

- Manage global payment infrastructure

They’re the middlemen between you, the bank, and the store you’re buying from.

Billing, Rewards, and Customer Support Systems

Every transaction flows into your account record. Issuers then generate:

- Monthly statements

- Reward calculations (cashback, miles, points)

- Support services, like dispute resolution, card replacement, and fraud protection

All of this runs on robust banking systems, backed by algorithms, customer service reps, and increasingly, AI.

The Benefits of Using a Personal Credit Card

Used wisely, personal credit cards can be powerful tools, not just for spending, but for building financial momentum.

Convenience and Global Acceptance

Credit cards are accepted almost everywhere, from coffee shops to car rentals to international airlines. Whether you're shopping online, booking hotels abroad, or grabbing lunch at a local café, your card offers seamless transactions across borders and platforms.

No need to carry stacks of cash. No currency conversions at kiosks. Just swipe, tap, or click.

Building and Improving Your Credit History

Your credit card activity is regularly reported to credit bureaus, which means it’s a direct contributor to your credit score.

- On-time payments = positive marks

- Low utilization = responsible behavior

- Long-standing accounts = stronger history

Over time, this translates to better loan offers, lower insurance rates, and more financial freedom.

Purchase and Fraud Protection

Credit cards often include layers of built in security and consumer protection:

- Fraud monitoring and alerts

- Zero liability for unauthorized charges

- Dispute resolution for shady transactions

- Purchase protection if an item is damaged or lost shortly after purchase

- Extended warranties on eligible products

This means peace of mind, whether you're buying a blender or booking a flight.

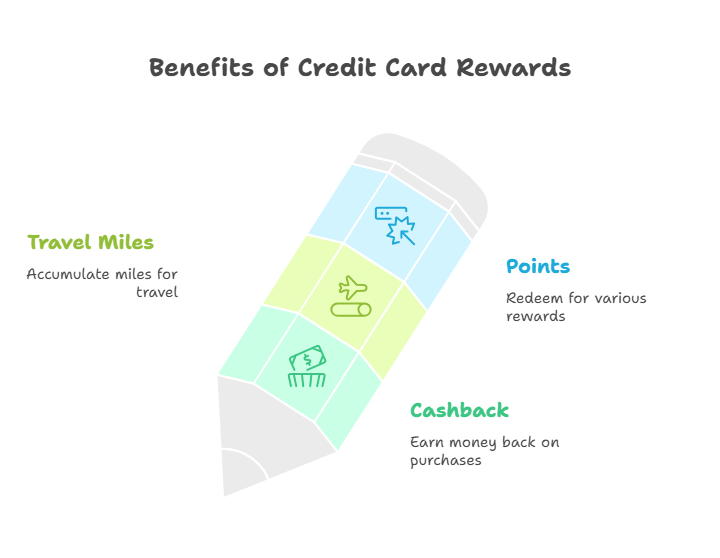

Reward Programs and Exclusive Perks

Who doesn’t want to get rewarded for spending? Depending on the card, you could earn:

- Cashback on groceries, gas, dining, or everything

- Travel miles for your next trip

- Points you can redeem for flights, gift cards, or merchandise

Some cards even offer VIP treatment: airport lounge access, concierge service, hotel upgrades. With the right match, your card can feel like a membership to a lifestyle.

The Risks & Responsibilities

Credit cards aren’t “free money”, they’re borrowed funds. And if you’re not careful, that convenience can turn into costly consequences.

Interest Charges and Debt Risk

Carry a balance? You’ll pay for it, literally. Credit card interest rates (APRs) are some of the highest in consumer finance, often topping 20%. A few missed payments can spiral into long-term debt that’s hard to escape.

Late Payments and Credit Damage

Miss your due date and you might:

- Get hit with a late fee

- See a penalty APR kick in

- Take a hit on your credit score

Even one late payment can linger on your credit report for years. It’s not worth it.

Misuse and Overspending

It’s easy to overspend when you’re not paying out of pocket in the moment. The emotional disconnect between buying and budgeting can lead to compulsive swiping, and serious regret when the bill arrives.

Impulse spending and lifestyle inflation are two common pitfalls of credit card misuse.

Hidden or Unexpected Fees

Some cards bury fees in the fine print:

- Foreign transaction fees

- Balance transfer fees

- Dormancy or inactivity fees

- Over-limit charges (yes, some cards still do this)

If you’re not reading the terms carefully, you might end up paying for features you never even used.

When managed responsibly, a credit card can be one of the most useful financial tools in your wallet. But just like any tool, misuse can lead to damage, sometimes the lasting kind.

Tips for Smart Credit Card Use

Want to unlock the best that personal credit cards have to offer, without falling into the traps? These habits are your roadmap to responsible and rewarding credit card use.

Always Pay Your Bill on Time

It’s the golden rule. On time payments not only help you avoid late fees and penalty APRs, they also protect your credit score.

Set up autopay or reminders, whatever it takes. Just never miss that due date.

Pay More Than the Minimum

Paying only the minimum keeps you in debt longer and racks up interest fast. Whenever possible, pay your full statement balance. If that’s not doable, pay as much above the minimum as you can to cut down interest costs.

Monitor Your Statements and Credit Score

Keep an eye on your monthly statements to catch errors, spot fraud early, and track your spending patterns.

Use apps like Credit Karma, Experian, or your card’s built-in credit score tracker to monitor your credit health regularly.

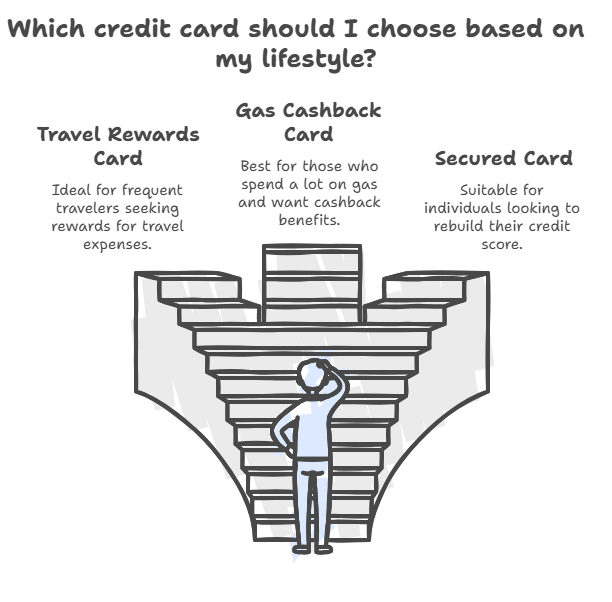

Choose the Right Card Based on Your Lifestyle

Don’t fall for flashy ads or big bonuses if the card doesn’t align with your spending.

- Love to travel? Get a travel rewards card.

- Always on the road? Go for gas cashback.

- Rebuilding credit? A secured card might be your best friend.

Pick a card that matches your habits, not just your wishlist.

Conclusion

Credit cards aren’t just financial accessories, they’re strategic tools when used with intention and understanding.

In this guide, you’ve learned what personal credit cards are, how they function, the different types available, and the features and perks that come with them. You’ve also explored the risks, responsibilities, and smart habits that separate the financially savvy from the financially stuck.

Here’s the bottom line: credit cards are tools, not crutches. When you swipe with purpose, paying on time, spending within your means, and choosing the right card for your lifestyle, you’re not just managing money. You’re building a foundation for financial freedom.

Use them wisely, stay informed, and let your credit work for you, not the other way aro und.