Your first credit card isn’t just plastic, it’s a key to your financial future.

It’s how you start building a credit history, unlock better loan rates, and earn your way to financial independence. But what if you’ve never had credit before? No score, no reports, no record. Just a clean slate.

Here’s the truth: you don’t need a credit history to get started. In fact, thousands of people, students, recent grads, immigrants, and young professionals, secure their first credit card with zero credit every single day.

In this guide, we’ll walk you through exactly how to do it, step by step. From understanding what “no credit” means to choosing the right card and using it smartly, consider this your starter playbook to unlocking the world of credit, without the confusion.

What “No Credit History” Really Means

When people say they have “no credit,” it’s easy to confuse that with “bad credit.” But the two are very different.

No credit history means you’ve never taken out a loan, used a credit card, or opened any financial account that reports to the credit bureaus (Equifax, Experian, and TransUnion). There’s simply no data to score. You're invisible to the system, not in a bad way, just not yet on the radar.

This is common if you:

- Are a college student or young adult just entering the financial world

- Recently immigrated to a new country and haven’t built U.S. credit yet

- Always used cash, debit cards, or prepaid cards and avoided credit

Why does this matter? Because credit card issuers rely on your credit history to predict how responsibly you’ll manage debt. No history = no past behavior to assess. But don’t worry, there are specific cards and strategies built for people just like you. You’re not locked out, you just need to start with the right door.

The Best First Credit Card Options for Beginners

Getting your first credit card without a credit history means playing it smart. Some cards are designed with beginners in mind, no score? No sweat. Let’s break down your best bets:

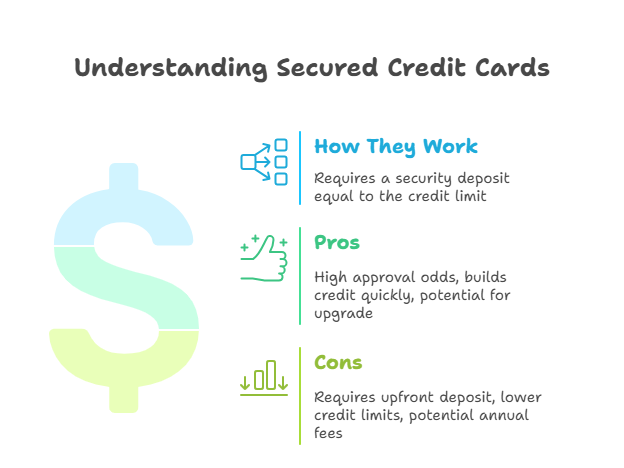

Secured Credit Cards

How They Work:

Secured cards require a refundable security deposit, usually the same amount as your credit limit. For example, if you put down $200, your spending limit is $200. That deposit protects the lender while you prove yourself.

Pros:

- High approval odds, even with zero credit

- Builds credit history quickly when used responsibly

- Often offers a path to upgrade to unsecured

Cons:

- Requires upfront cash deposit

- Lower credit limits

- May come with annual fees (not always)

Top Picks:

Card Name | Deposit | Annual Fee | Notable Feature |

Discover it® Secured | $200+ | $0 | Cash back rewards + free FICO score |

Capital One Platinum Secured | $49–$200 | $0 | Low deposit options + upgrade path |

OpenSky® Secured Visa® | $200+ | $35 | No credit check required |

Student Credit Cards

Why They’re Great for Students:

These are designed specifically for college students, no deposit required. If you’re enrolled in school and have some form of income (job, allowance, financial aid), you’re in the game.

What You’ll Need:

- Proof of income or financial aid

- School enrollment verification

- A U.S. address and Social Security Number (SSN)

Best Student Cards Available:

- Discover it® Student Cash Back – Rewards + no annual fee

- Chase Freedom Rise® – 1.5% cash back + higher approval if you bank with Chase

- Deserve EDU Mastercard – Great for international students, no SSN required

Unsecured Starter Cards

What Sets Them Apart:

Unsecured cards don’t require a deposit. Some are built for folks with limited or no credit and base approval on other factors, like income and banking history.

Approval Factors:

- Steady income

- Active bank account

- Responsible bill paying history (e.g., rent, phone bill)

Suggested Options:

- Capital One Platinum Credit Card – No annual fee, good for credit builders

- Petal® 2 Visa® – Uses alternative data like cash flow; no fees

- Chase Freedom Rise® – As mentioned, great all rounder

Become an Authorized User

What It Means:

Someone (a parent, sibling, or trusted friend) adds you to their existing credit card. You get a card with your name, and their payment history shows up on your credit report.

Why It Helps:

- No credit check required

- You don’t have to manage the account

- You benefit from their on-time payments

When It’s Ideal:

- The primary cardholder has excellent credit habits

- You trust them to pay on time

- You want a low-risk way to build credit fast

Cards for Newcomers & International Students

Tailored Options Exist, Even Without U.S. Credit:

Some credit card issuers partner with companies that allow you to apply using your international credit history or ITIN instead of an SSN.

Issuers to Consider:

- Firstcard® Credit Builder – No SSN needed, designed for immigrants and new arrivals

- American Express (via Nova Credit) – Transfers your home country credit file

- Deserve EDU – International student-friendly, no U.S. credit needed

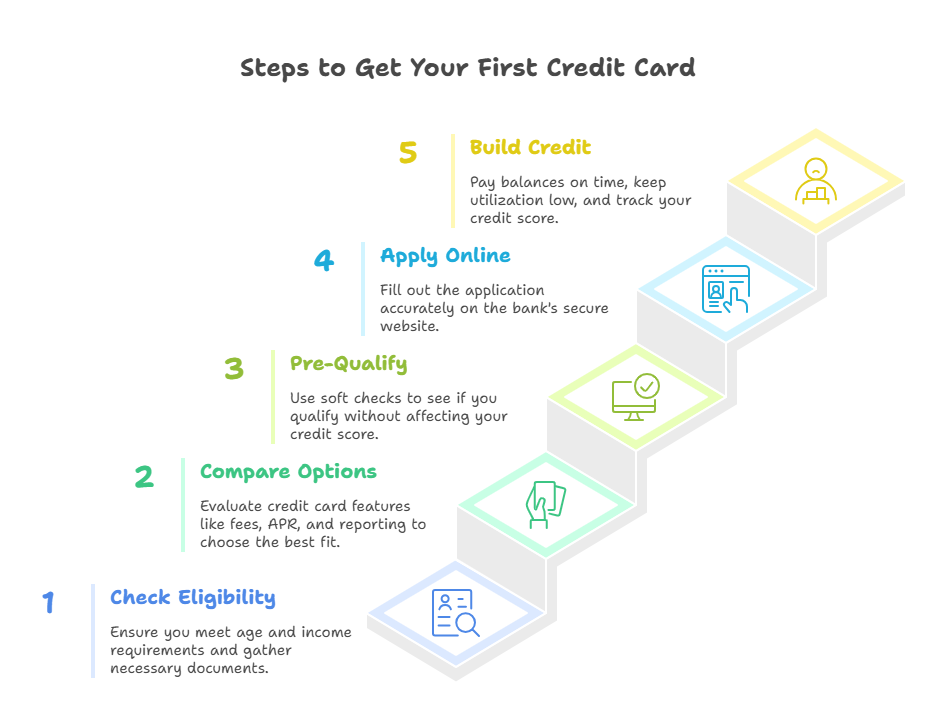

Step by Step Guide to Applying

Here’s how to go from no credit to holding your first card, without the guesswork.

1. Check Your Eligibility

- You must be 18+ years old

- You need a source of income (job, freelance, stipend, or financial aid)

- Gather key documents: SSN or ITIN, proof of income, valid ID

2. Compare Credit Card Options

Look for:

- No annual fee

- Low APR

- Reports to all 3 credit bureaus

- Potential to upgrade

- Decide what matters most: rewards, building credit, or no deposit?

3. See if You Pre Qualify

- Many banks offer a “soft check” pre-qualification tool

- No impact on your credit score

- Helps avoid unnecessary rejections

4. Apply Online (The Right Way)

- Choose your card

- Apply through the bank’s secure website

- Fill in all details accurately, don’t guess on income

- Use a professional email (no more hotgirl1999@gmail)

5. Start Building Credit Responsibly

- Pay your balance on time, every time

- Keep utilization under 30% (e.g., use $60 on a $200 limit)

- Set up automatic payments to avoid missing due dates

- Track your credit score monthly (tools like Credit Karma, Discover Scorecard)

Top Starter Cards – Quick Comparison Table

Looking for the best first card to start your credit journey? Here’s a side-by-side look at top beginner-friendly credit cards, so you can compare and choose what fits your vibe and goals:

Card Name | Type | Deposit Required | Annual Fee | Rewards | Standout Features |

Discover it® Secured | Secured | $200+ | $0 | 2% cash back on gas & dining | Free FICO score, automatic reviews for upgrade |

Capital One Platinum Secured | Secured | $49–$200 | $0 | None | Low deposit to limit ratio, upgrade path |

OpenSky® Secured Visa® | Secured | $200+ | $35 | None | No credit check, fast approvals |

Chase Freedom Rise® | Unsecured | None | $0 | 1.5% cash back | Better odds if you bank with Chase |

Petal® 2 Visa® | Unsecured | None | $0 | Up to 1.5% cash back | No fees, uses banking history, modern mobile app |

Deserve EDU Mastercard® | Student | None | $0 | 1% cash back | No SSN required, great for international students |

Firstcard® Credit Builder | Secured | None (ITIN accepted) | $0 | Yes | 0% APR, no SSN required, ideal for newcomers |

Note: Always confirm terms on the issuer’s official site before applying, offers can change.

Smart Tips to Increase Your Chances

Even if you’re just starting out, you can position yourself like a pro. Follow these credit smart moves to boost your approval odds and build solid habits from day one:

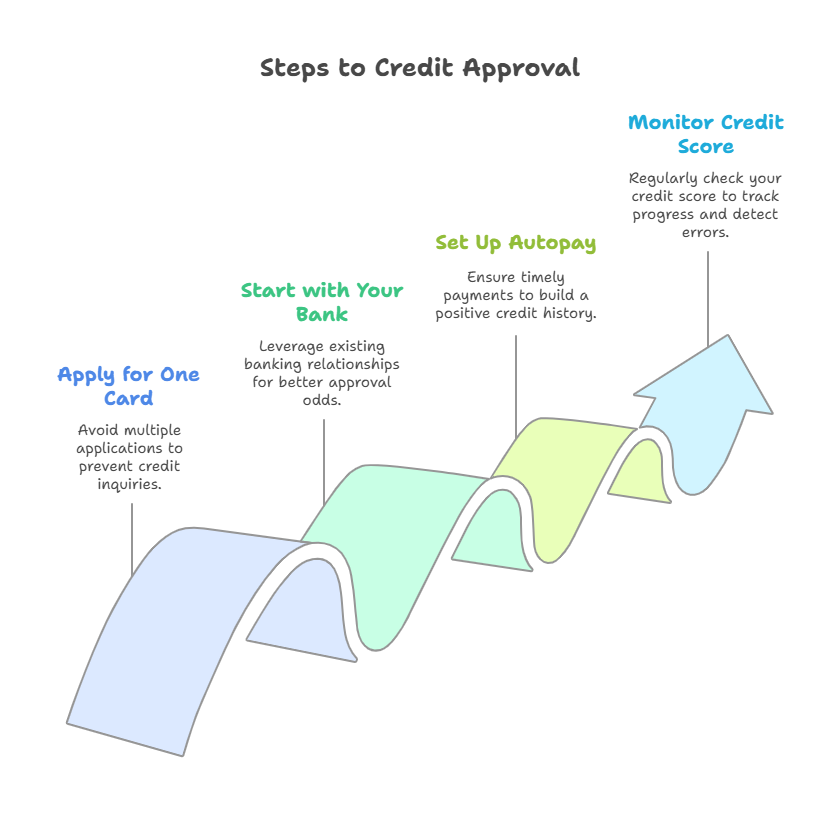

Don’t Apply for Multiple Cards at Once

Every application triggers a hard inquiry on your credit. Too many in a short period? Red flag for lenders. Stick to one solid application at a time.

Start with Your Bank or Credit Union

Got a checking or savings account? That’s your foot in the door. Many banks offer beginner-friendly cards to existing customers, with better approval odds.

Set Up Autopay Immediately

Even one missed payment can damage your credit. Autopay ensures your minimum (or full) balance is always paid on time, helping you build a positive payment history effortlessly.

Monitor Your Credit Score Regularly

Use tools like:

- Credit Karma

- Discover Credit Scorecard

- Experian App

These let you track your credit building progress and catch any errors or fraud early.

Resources for Further Learning

Want to go deeper or explore your options further? Here are some expert-approved tools, guides, and platforms to help you navigate your first credit move:

Trusted Guides & Articles

- Capital One: Getting a Credit Card With No Credit History

- NerdWallet: Best Starter Credit Cards for No Credit

- Experian: How to Build Credit With No Credit History

- Bankrate: How To Choose A Card For No Credit

- Chase: Credit Cards for No Credit History

Credit Tools & Apps

- Credit Karma – Free credit score monitoring and card matching

- WalletHub – Daily credit score tracking and card recommendations

- Experian Boost – Helps you build credit by reporting utility and phone payments

- Petal App – Track spending, manage payments, and view credit-building insights

Conclusion

Getting your first credit card with zero credit history might seem like a maze, but now you’ve got the map.

Whether you choose a secured card, a student card, or become an authorized user, the key is to just get started. The first card is your entry point, not your final destination.

Use it wisely. Pay on time. Keep balances low. Monitor your credit. Before you know it, you’ll be eligible for better cards, lower rates, and bigger financial opportunities.

You’ve got this. Let today be the start of your credit journey.

Grab Your Freebie: Beginner’s Credit Toolkit (PDF)

Includes:

- Credit card comparison worksheet

- Application checklist

- Monthly payment tracker

- List of beginner cards with pros and cons

- Bonus: “Do This, Not That” cheat sheet for new cardholders