When you're running a business, whether solo or with a growing team, every financial move matters. One tool many entrepreneurs turn to is the American Express business credit card. But here's the catch: while it's branded as a "business" card, what happens behind the scenes might touch more than just your business credit.

Understanding how Amex business cards interact with both your personal and business credit reports is essential. From the moment you apply to how you manage the card over time, the effects can ripple through your credit life. This guide breaks down the nuances, so you can make smarter decisions that protect your credit standing, on both fronts.

How American Express Business Cards Affect Personal Credit

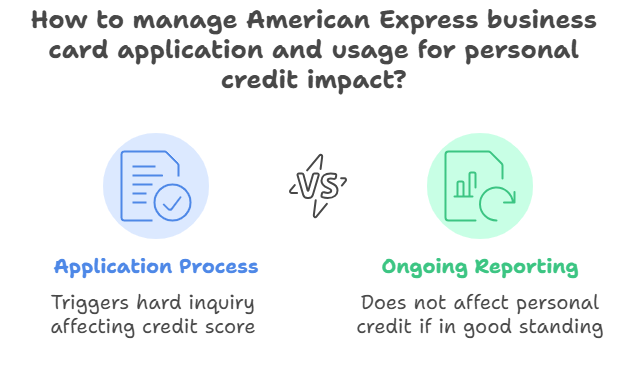

Application Process

Before you ever swipe the card, Amex takes a peek into your personal financial world. Applying for an Amex business credit card typically triggers a hard inquiry on your personal credit report. This is standard practice across most issuers, as they want to assess your reliability as the personal guarantor for the account.

A hard inquiry can shave a few points off your credit score, nothing catastrophic, but noticeable. It also stays on your credit report for up to two years, though it only impacts your score for about 12 months. So, if you're applying for a mortgage, auto loan, or other big ticket financing soon, time your Amex application wisely.

Ongoing Reporting

Once you're approved and actively using the card, here's where things diverge from the typical consumer credit card experience: Amex does not report your ongoing business card activity to personal credit bureaus, as long as your account remains in good standing.

That means your balances, payment history, and utilization on the business card won’t affect your personal credit score. This is a major win for entrepreneurs looking to keep personal and business finances separate. You can spend strategically for your business without worrying about wrecking your personal credit utilization ratio or debt-to-income outlook.

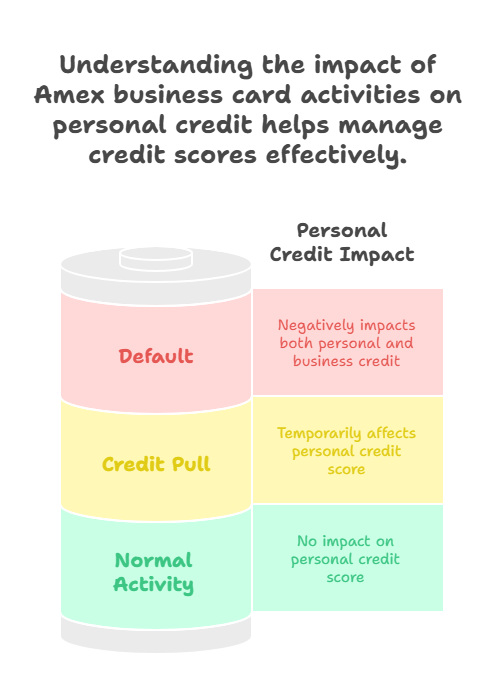

Exceptions: Delinquencies and Defaults

Here’s where the firewall can crack. If you miss payments, fall severely behind, or default on your Amex business card, the gloves come off. Because you’re personally guaranteeing the account, Amex reserves the right to report delinquencies or defaults to personal credit bureaus, even though it’s a business card.

Translation? If things go south, your personal credit score will take the hit. This can impact your ability to get loans, secure lines of credit, or even qualify for another credit card, business or personal.

In short: while Amex business cards generally operate on a “no report unless there’s a problem” basis when it comes to personal credit, the moment things go sideways, the consequences get personal, fast.

American Express Business Card Reporting: Personal vs. Business Credit Impact

When you're running a business, whether solo or with a growing team, every financial move matters. One tool many entrepreneurs turn to is the American Express business credit card. But here's the catch: while it's branded as a "business" card, what happens behind the scenes might touch more than just your business credit.

Understanding how Amex business cards interact with both your personal and business credit reports is essential. From the moment you apply to how you manage the card over time, the effects can ripple through your credit life. This guide breaks down the nuances, so you can make smarter decisions that protect your credit standing, on both fronts.

How American Express Business Cards Affect Business Credit

Business Credit Reporting

Here’s where things get a bit more opaque.

While most business owners assume their American Express business card activity is helping build their business credit profile with the big three, Dun & Bradstreet, Experian Business, and Equifax Business, the reality is more nuanced.

Amex does not typically report positive, routine activity (like on-time payments or low utilization) directly to these major business credit bureaus. Instead, they report to the Small Business Financial Exchange (SBFE), a lesser known, behind the scenes data aggregator used by lenders to assess small business creditworthiness.

Think of SBFE like a private vault of business credit behavior. Lenders and underwriters can access this data when making credit decisions, even if it’s not reflected in your visible Dun & Bradstreet Paydex score or Experian Intelliscore. So while you may be building some credibility in the background, you’re not actively building your public-facing business credit scores unless you’re working with lenders that pull directly from the SBFE network.

Bottom line? Don’t rely on your Amex alone to grow your business credit profile. Diversify your credit-building strategy with vendors and cards that report to the bureaus you know are being scored.

Negative Activity

While Amex keeps your good behavior mostly in the shadows of SBFE, they’re not shy when it comes to bad behavior.

If your business account experiences delinquencies, defaults, or charge offs, Amex can report this negative information directly to business credit bureaus, including Dun & Bradstreet and others. These black marks can seriously damage your business credit standing, making it harder to qualify for loans, leases, or future lines of credit.

In other words: what happens in Vegas may stay in Vegas, but what happens when you stop paying your Amex bill will definitely follow you.

So while Amex might not help you build business credit in the traditional way, it absolutely has the power to break it if you’re not managing payments responsibly.

Comparison Table: Amex Business Card Reporting

Impact Area | Routine Reporting | Delinquency/Default | Application Impact |

Personal Credit | No | Yes | Hard inquiry |

Business Credit | SBFE only | Yes (to bureaus) | None |

Key Takeaways

- Application triggers a personal credit pull.

When you apply for an Amex business card, expect a hard inquiry on your personal credit report. It’s standard, and while temporary, it can affect your score. - Routine card use doesn’t affect personal credit.

Amex doesn’t report everyday business card activity to personal credit bureaus, so your balances and payments don’t impact your FICO, unless things go wrong. - Delinquencies or default can harm both credit profiles.

Fall behind on payments and Amex can hit both your personal and business credit with negative marks. The personal guarantee makes you fully liable. - Amex business card activity may not build traditional business credit but is still visible through SBFE.

Positive behavior is reported to the Small Business Financial Exchange (SBFE), used by lenders, but not by major credit bureaus like Dun & Bradstreet.

Conclusion

American Express business credit cards walk a fine line between personal and professional responsibility. They’re built to keep your business and personal credit mostly separate, which is a huge plus for entrepreneurs. But don’t mistake “separate” for “untouchable.”

If used responsibly, your Amex business card won’t appear on your personal credit report, and won’t help or hurt your score. But miss a payment or default? That firewall collapses fast, and both your personal and business credit can take serious hits.

And while Amex doesn’t directly help build your business credit with bureaus like Dun & Bradstreet, the SBFE data trail still matters, especially to future lenders.

Bottom line: use your Amex like the business tool it is. Stay on top of payments, monitor your spending, and know that your credit, on both sides of the fence, is riding on your choices.